Two students, Rebecca Poulsen and Taylor Steed, have been collecting signatures for a proposed ballot initiative. If they collect roughly 115,000 signatures the choice will be up to voters. In locations outside of the Salt Lake Valley, the initiative is going so far as offering $1,000 to gather 1,000 signatures.

The Clean the Air Carbon Tax Act proposes a tax of $12 per metric ton of carbon dioxide emissions on fossil fuels, such as gasoline, jet fuel, and coal — which comes out to approximately 11 cents per gallon of gas and 1 cent per kilowatt hour of electricity, according to the sponsors of the bill.

The bill’s text states that revenue from the proposed tax would be used to eliminate sales tax on grocery store items and use what’s left to pay for rural economic development and clean air projects.

According to a fiscal impact analysis by economist and co-sponsor of the bill, Yoram Bauman, those in the lowest two income brackets may “come out ahead”.

An average household in the lowest income bracket would save $105 and an average household in the second-lowest income bracket would save $67 when the income brackets divide the population into fifths. The website includes a calculator provided by the bill’s sponsors to help people determine how much the proposed law would affect taxpayers.

When asked how Bauman justifies proposing a tax increase as a Republican he said “we all have to breathe” and spoke of the importance of the “limited role” that governments play by investing in our air as we do public infrastructure, such as roads and schools.

Rebecca Poulsen and Taylor Steed said that to them, reducing pollution is a worthy reason to increase taxes.

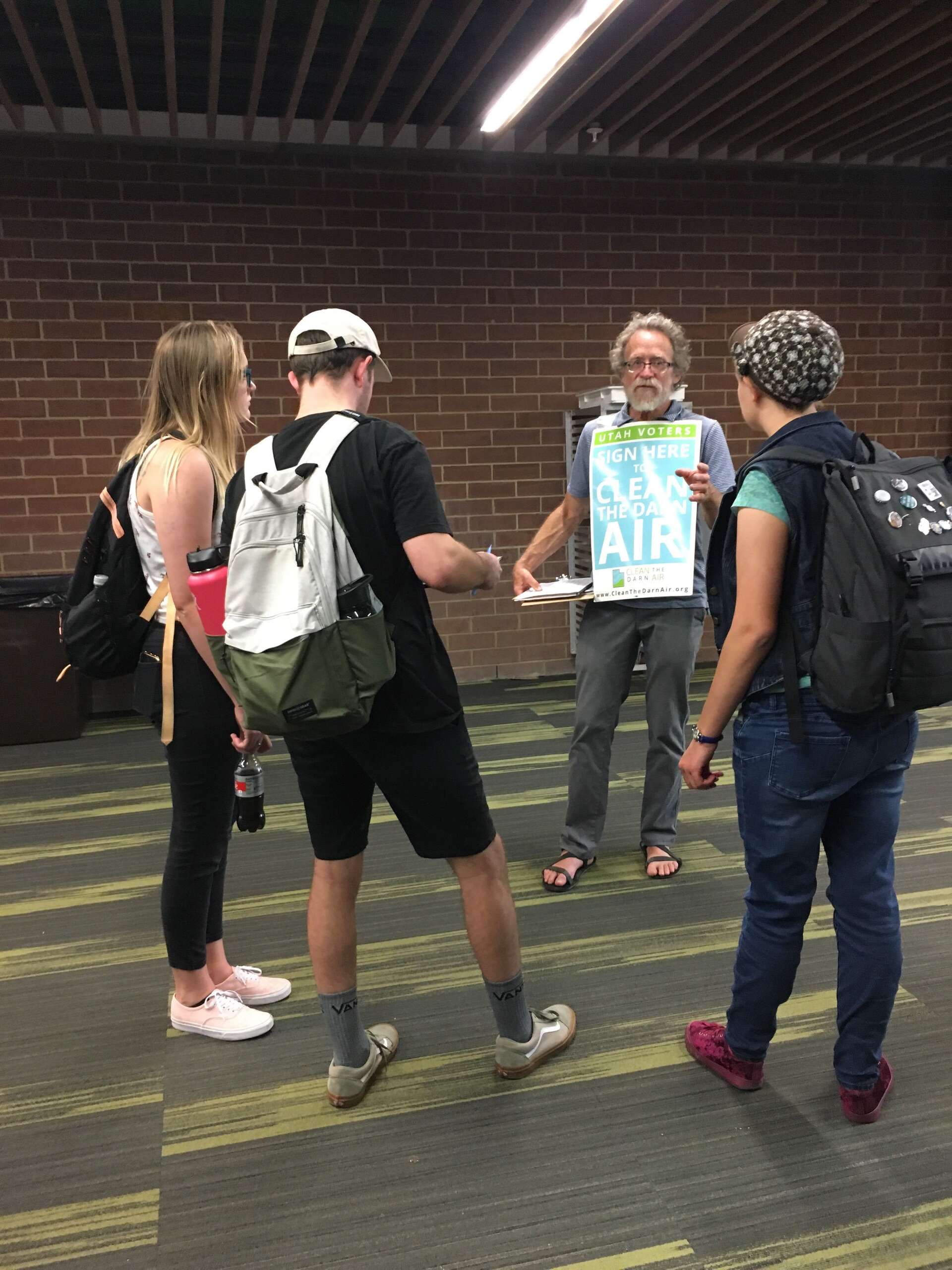

Support from the younger generations on climate related issues is why the Clean the Darn Air Initiative is focusing its work at universities in the state, said Dave Carrier, an activist, professor and co-sponsor of the initiative.

Regarding opposition to the measure, Yoram Bauman said that they do not expect the same level of criticism for the measure as the carbon tax measure which he worked on in Washington State. The bill was dragged for “not being the Green New Deal” said Bauman. The measure did not pass in the general vote there after organizations such as the Sierra Club came out in opposition.

Critics of the bill point to rising costs for the consumer for expenses that they are unlikely to change. In an interview with the Salt Lake Tribune, Heather Williamson, Utah director of Americans for Prosperity, said “People aren’t going to stop heating their homes. Neither will they stop driving to work or school in the morning, in that case, emissions don’t fall but prices still rise.”

In his interview with the Salt Lake Tribune, Bauman said “Markets aren’t magical things that just automatically go in whatever direction you want them to go in. They respond to incentives.”

In spite of criticism for the conservative approach, students are eager to do something to clean the air and are busy collecting signatures. But with roughly 115,000 to collect in total, the Clean the Darn Air initiative continues to search for more help.

For more information on the bill or to find out how to get involved visit www.cleanthedarnair.org or reach out via email to Taylor (taylor@darnair.org) or Rebecca (becca@darnair.org).

Photos by Christian Fullmer